VIX LAUNCHES AI TRADING FEATURE ON ONLINE TRADING PLATFORM

In recent years, the competition among securities companies in brokerage activities has often been based on traditional factors such as: (1) Coverage of the brokerage team network. (2) Quality of investment consulting activities. (3) Convenience of trading software. (4) Diversity of capital sources and financial service products. However, these traditional competitive factors are gradually changing. Accordingly, the application of AI may be the most crucial point in supporting brokerage and investment consulting activities and creating profits, thereby establishing a differential and long-term competitive position for a securities company.

Grasping this trend, with the desire to help customers make more positive changes in accessing Big data, VIX Securities Joint Stock Company launched an additional AI trading feature integrated on the trading platform. Visit https://xpower.vixs.vn/priceboard for more information.

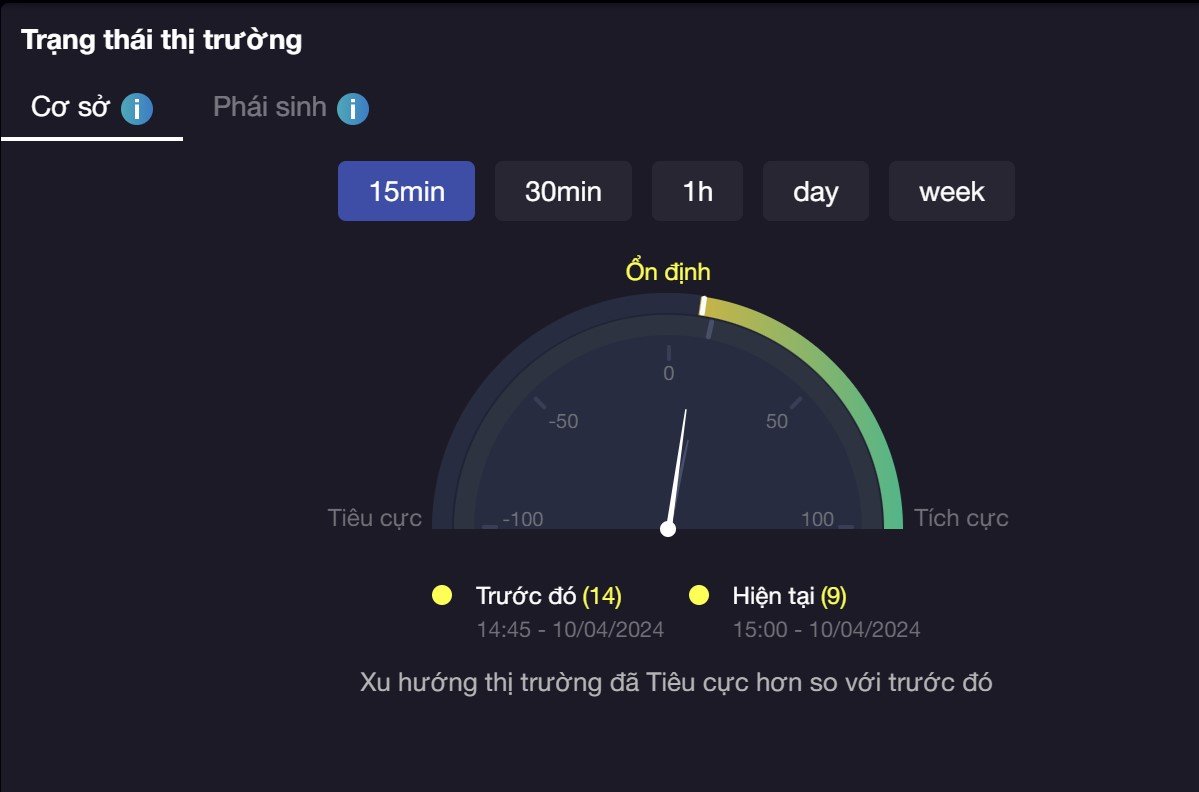

- Market Status Clock:

This tool allows investors to monitor real-time market risk status and indicate market risk trends in different time frames. Investors can make buy/sell decisions promptly based on the color of the clock’s needle pointing:

- Green: Indicates a positive market status.

- Gold: Represents a steady-state market.

- Red: Indicates a negative market state, prompting caution before making buy/sell decisions.

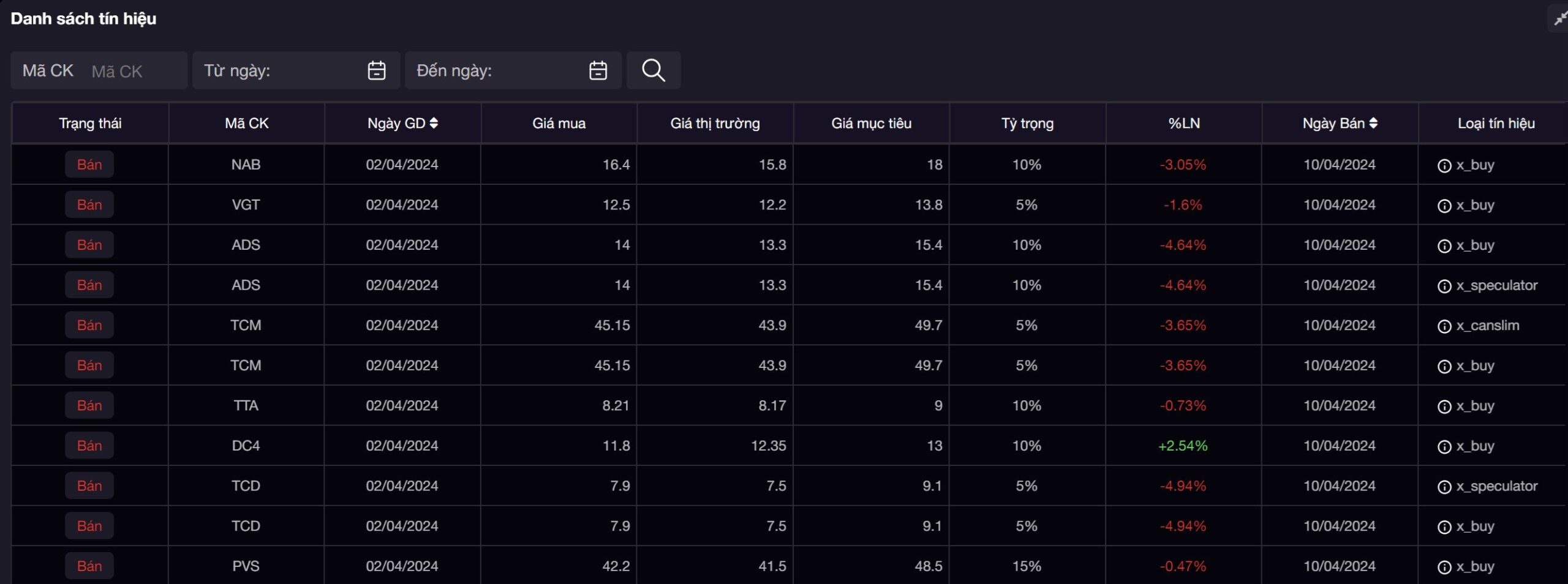

2. Signal List:

The artificial intelligence system utilizes Machine Learning algorithms to synthesize buying and selling signals by analyzing Industry Ranking scores, Stock Ranking scores, and Market Risk Status in real time. Recommendation Signals provided to investors are a list of stock codes predicted by AI to have a high probability of price increase in the market.

Stock signals include: X-Buy, XM Buy, X-Speculator, X-Canslim, X-Darvas, X-Keltner. Investors can easily filter and search for stock codes of interest within a specified period, thereby evaluating the effectiveness of signals given by AI.

3. Industry Rankings:

This tool utilizes artificial intelligence technology to consolidate data from over 50 reputable financial sources, including HOSE, HNX, Yahoo Finance, Bloomberg, Investing.com, Refinitive Eikon, financial reports of major listed companies, Securities and Exchange Commission, and financial institutions and brokerage firms.

Industry rankings provide information about industries currently attracting the most attention, with the most positive business outlooks, and attracting significant investment. Investors can quickly determine which industries are worth investing in based on the provided ratings.

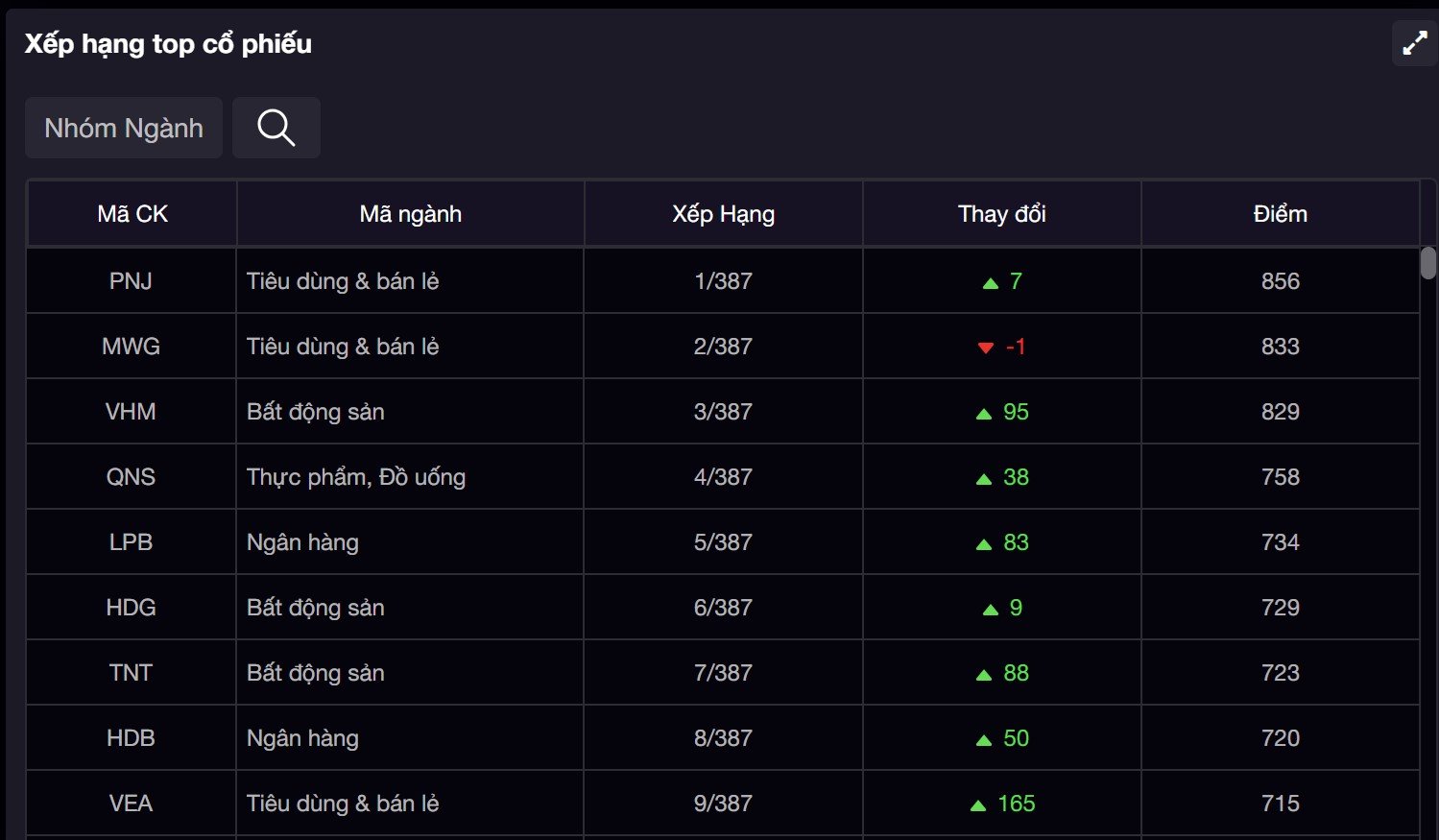

4. Stock Ratings:

The Stock Ranking tool displays the score of each stock based on data from 50 reputable financial sources, processed by AI algorithms to give ratings to stocks. This score reflects criteria related to cash flow, technical indicators, financial health, etc., to evaluate the current situation of each stock.

The rated stock basket includes 387 stock codes selected according to liquidity and financial health criteria of the S&P 500. Investors rely on the provided indices to make investment decisions for each stock effectively, particularly when combining factors such as Trading Volume, Market Trend, Stock Trend, and Cash Flow.

For detailed descriptions and instructions for use, please refer HERE.

For further information, please contact:

VIX Securities Joint Stock Company

Floor 22, No. 52 Le Dai Hanh Street, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi city

Phone: +8424 4456 8888 | Fax: +8424 3978 5380

Email: dvkh@vixs.vn